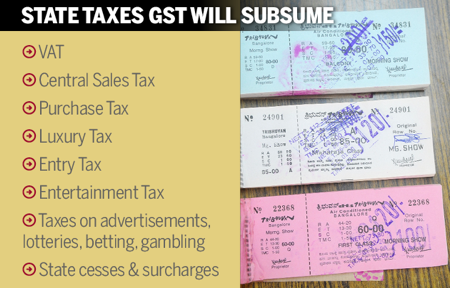

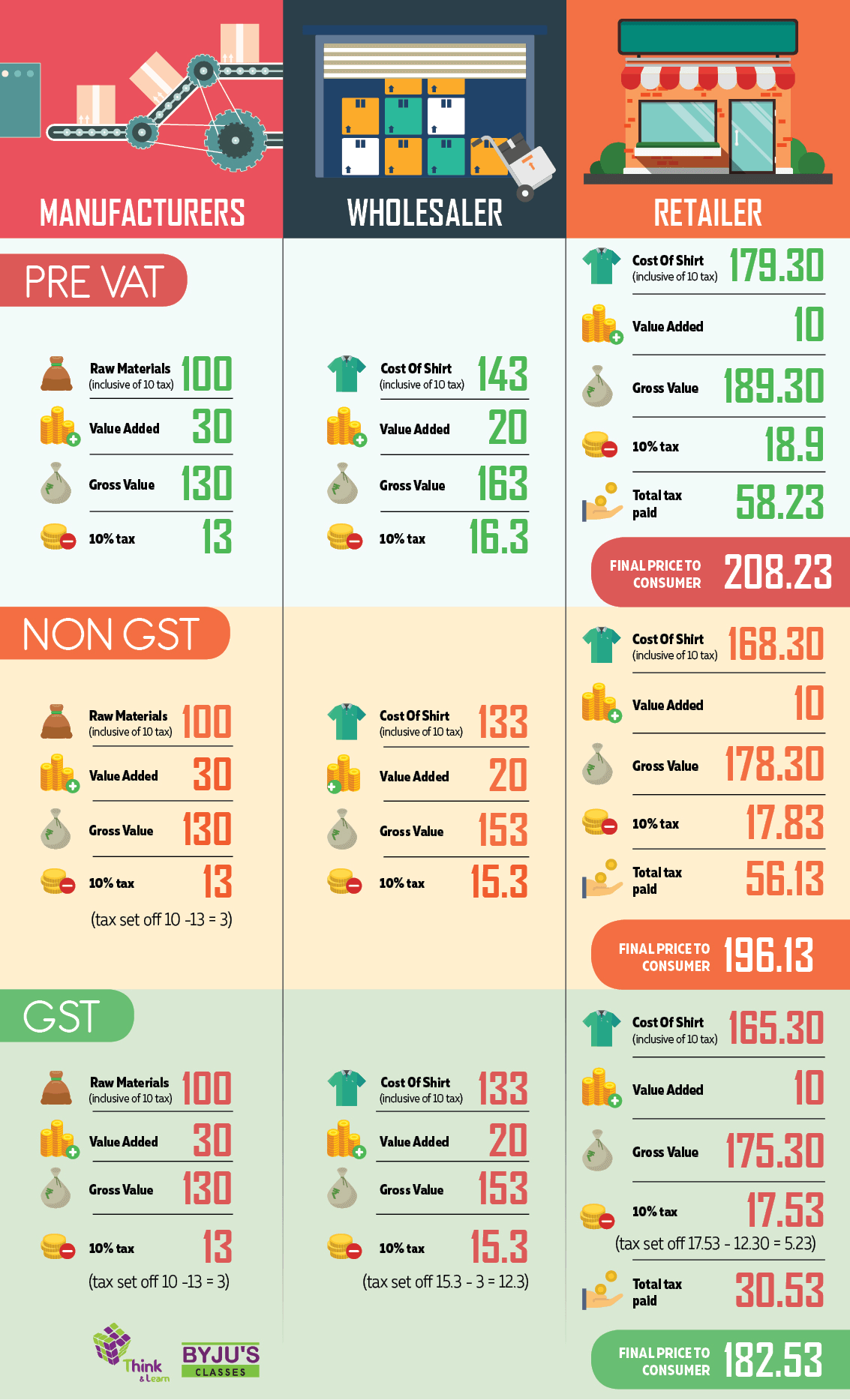

GST Bill has now paved its way for the concept of one nation, one tax. The Goods and Service Tax will enable both the Center and States to simultaneously levy GST, which will subsume all indirect taxes currently levied, including excise duties and service tax. GST would mitigate double taxation by amalgamating central and state tax into one. Currently goods and services sold in India are taxed at 25% ~ 30% from the source to consumer by state, central and local administration. Post GST, the tax on goods and services will be in the range of 5% ~ 28%.

There are more than 150 countries that have introduced GST. So, India will also join the league whereby the government of the country wishes to simplify the tax regime. 23 states in India have ratified the GST Bill. The bill after ratification by majority of states have received assent from President of India. India has decided to opt for dual GST system.

Features of GST:

- Applicable on supply of supply of goods and services.

- List of exempted goods and services would be kept to a minimum.

- It will be Destination based tax as against present concept of origin based tax.

- It would be a dual GST with the Centre and the States simultaneously levying it on common base.

- GST levied by central government would be CGST and state government would be SGST

- CGST and SGST would be levied at rates to be mutually agreed upon by the Centre and the States based on the revenue-neutral rates.

- More than 200 items may be excluded from GST which includes some services related to shipping and port activity

The Need for GST

GST will help in reducing tax evasion. It will weed out the current shortcomings of the supply chain owing to the complicated, multi-layered tax policies. All traders will insist on taking bills for all their purchases. All the distributors will prefer to purchase with invoice, because it gives them a better profit margin. This is because; the distributor will get credit for all the taxes paid at the previous stage. In the present scenario, the distributor has to bear the burden of excise duty. Therefore for him, it makes more sense to simply avoid paying taxes. GST would ensure that there is minimal cascading of taxes. This would reduce hidden costs of doing business.

Need of GST:

- Single tax system which is expected to be simpler and easier to understand.

- Reduction in paperwork and accounting complexities

- Single tax system will reduce the final consumption price, which will boost consumption and in turn beneficial to companies.

- It will boost exports and help the exporters to compete with manufacturers abroad and give competitive process.

How GST Works

Ours is a federal structure and keeping in mind the same GST will have three components – Central GST (CGST), State GST (SGST) and Integrated GST (IGST). Both Centre and States will simultaneously levy GST across the value chain. Centre would levy and collect Central Goods and Services Tax (CGST), and States would levy and collect the State Goods and Services Tax (SGST) on all transactions within a State. In case of inter-State transactions, the Centre would levy and collect the Integrated Goods and Services Tax (IGST) on all inter-State supplies of goods and services under Article 269A (1) of the Constitution. The IGST would roughly be equal to CGST plus SGST. The IGST mechanism has been designed to ensure seamless flow of input tax credit from one State to another.

Cross utilization of credit of CGST between goods and services would be allowed. Similarly, the facility of cross utilization of credit will be available in case of SGST.

How GST Ready is India

Building the world’s largest and most complex tax system in a few months is a herculean task. With GST coming into action there will be a significant change in the manner in which business is done in India. GST will call for best practices in business, training teams and IT systems to be GST ready and gearing up to face challenges to implement the changes brought by the implementation of GST.

The Business sector needs to be GST compliant, based on the size, geographic location and sector and be able to adapt to the system change in time. The changes due implementation of GST would be substantial and requires proactive planning with a time-bound action plan.

For Business sector to be GST compliant the there are few points need to be kept in mind:

- Government needs to organise seminars to make the business sector GST ready.

- To make Business sector aware about the new system and the implementation process.

- Government should make efforts to understand the effects of GST implementation and take inputs from the business sector for better impact of GST in India.

- Potential changes in the accounting system and IT system of the government and the companies requiring training before implementation of the same.

- Providing sufficient time to change from the existing system to the new GST system

- Government should make the business sectors and consumers aware about the rise in inflation due to implementation of GST. The rise in inflation would be temporary.

- GST Council needs to be come clean on tax structures among different product types. For example, All cars will be taxed at 28%. Luxury cars above certain price point will entail additional levies above 28%. Industry players are mulling standard rates for three wheelers, electric cars, hybrid vehicles and standard buses.

- GST is likely to give a boost to all industries but lack of clarity on certain ambiguous issues is accounting for a lukewarm response to GST from business units.

How is GST beneficial for Shipping and Maritime ?

Implementation of the GST Bill will put the distribution of goods and services on a faster track and improve operational efficiencies.

Post GST, India will try to cope up with the international standards in shipping and maritime taxing. Industry experts predict that inbound international freight may be zero rated.

Zero rated supply means a supply of any goods and /or services on which no tax is payable but credit of the input tax related to that supply is admissible. In most parts of the world, exports are zero rated.

Any service supplied in India is subject to GST at either standard rate or zero rate. The rate and changes to GST are under the purview of GST Council. Here is our forecast for shipping and maritime industry in India, post GST.

- Port services, defence services and exports may be zero rated

- The sale of ship is treated as supply of goods. The sale of ship by a GST registered company in India may be subjected to standard rate. If the ship is exported, then the supply would be zero rated

- The hiring of ship without crew or any other provision is called bareboat charter. Such hire may be subjected to standard rate under GST

- Every ship arriving at the Indian port would need navigational, ship handling and other services from port authorities. Such services may be subjected to zero rate in upcoming GST regime, making Indian companies more competitive on the international front.

- Goods and Services purchased by crew members for personal use from port stores may not be subjected to GST

- Maintenance and repair of the ship may be zero rated under the GST. Services provided by shipping agents, ship brokers or ship managers may also be zero rated

Conclusion

A lot has been talked about GST and the entire nation is eagerly waiting for it to be implemented. GST will bring about a reform in the way India is doing business. Simplification of tax regime is the aim while incorporating GST, reducing the complication involved in the filing of tax returns and reducing the paper work is addition to merits of GST. GST will also help in boosting the GDP of India. The export price of the goods and services will be more competitive giving better standing to Indian business.GST would also have negative impact on the economy in the short run i.e. there will be rise in inflation and this would affect the purchasing power of the consumer. Government has to issue guidelines for the implementation of GST so that the Business sector as well the consumers are well informed in advance the effect of implementation of GST on Indian economy. According to experts, by implementing the GST, India will gain $15 billion a year. This is because; it will promote more exports, create more employment opportunities and boost growth. It will divide the burden of tax between manufacturing and services. In the GST system, taxes for both Centre and State will be collected at the point of sale. Both will be charged on the manufacturing cost. Individuals will be benefited by this as prices are likely to come down and lower prices mean more consumption, and more consumption means more production, thereby helping in the growth of the companies. It will also help to build a transparent and corruption-free tax administration.

GST will ensure that indirect taxes rates and structures are common across the country, thereby increasing certainty and ease of doing business.

References –

http://www.livemint.com/Politics/57Su5e8TQv6r6PdcrLof1H/GST-Game-changer.html

http://byjus.com/free-ias-prep/goods-services-tax-gst-one-nation-one-tax-2-for-upsc-current-affairs